G.C.A. 505 Officers

Anthony Simon

General Chairperson

Vincent Tessitore

Vice General Chairperson

Michael Denn

Secretary

Local Chairpersons

Joseph Castaldo

Eugene Chino

Michael Denn

Jeffrey Finn

Anthony Lavoratore

Christopher Leathers

Christopher Smith

Vincent Tessitore

Jason Valdemira

| ||||

|

LaborPress.org honors General Chairperson Anthony Simon with the Labor Leadership Award

General Chairperson Simon outlines the details of proposed Contract.

As contract talks are ongoing, General Chairman Anthony Simon and members of the General Committee meet with the new SMART General President, Michael Coleman, in Washington DC. Coleman pledges his full support to SMART members on Long Island and will provide whatever assistance necessary to achieve our goals.

G.C. Anthony Simon on scene of Hall Interlocking Derailment

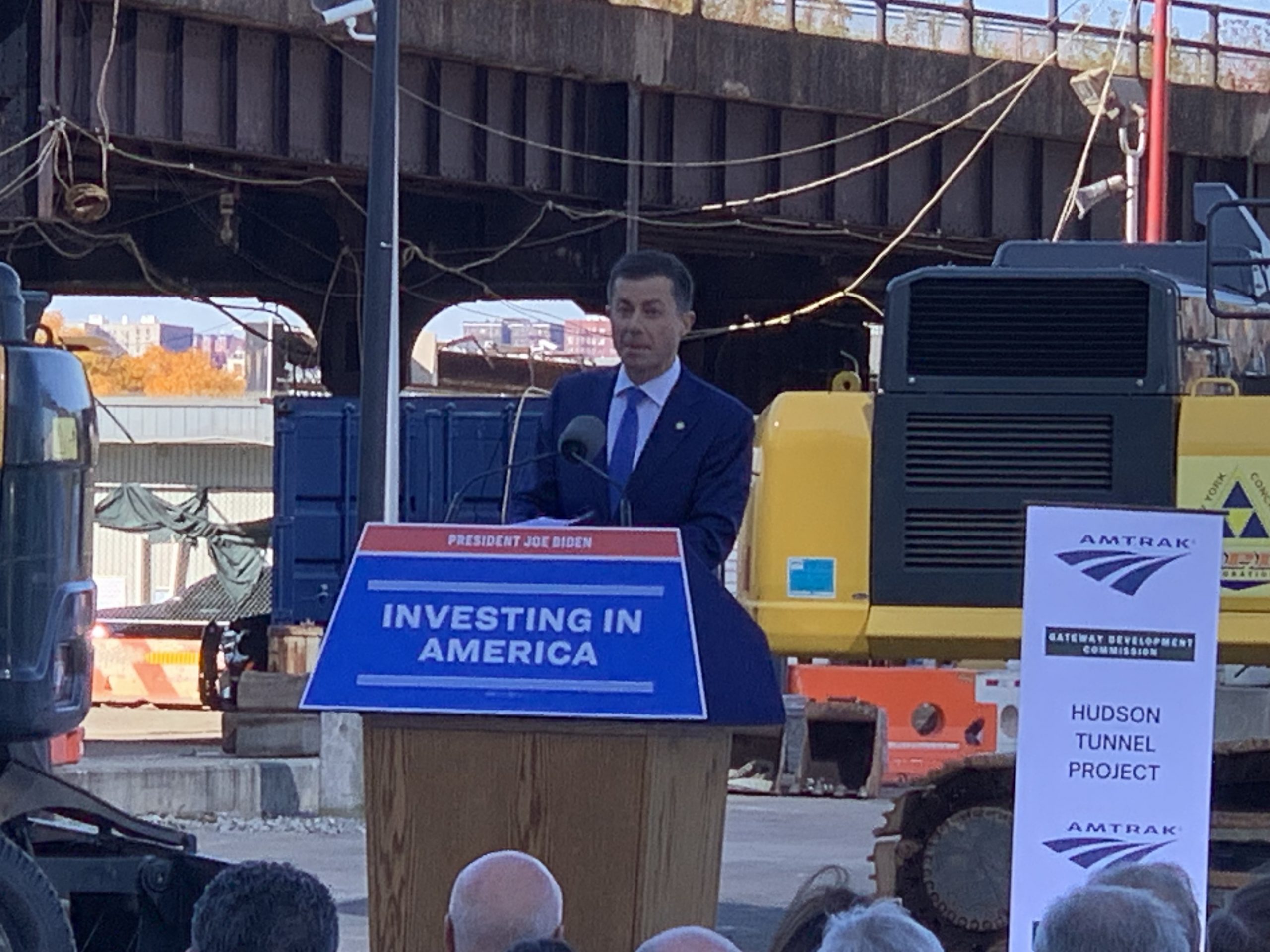

Secretary of Transportation Buttigieg speaks on the progress of the Gateway Project.

General Chairperson Anthony Simon meets President Biden after Gateway Project Press Conference.

Updated Information

Railroad Retirement will be holding a Pre-Retirement Seminar in Massapequa on May 10, 2024. The seminar has reached capacity and registration is now closed.

G.C. Simon and Committee tour new GCM station

G.C. Anthony Simon unveils Grand Central Madison at Opening Ceremony

Metro-North Track Local 808 invite G.C. Simon to speak to members on the importance of Unionization

SMART Leadership continuing to pave the way and provide for our members.

1788_001SMART Resolution of Matters Cover Letter

“Our Union will work this from every side to ensure our member’s safety. We will never stop!”

– Anthony Simon

“What makes a union

strong is the resolve

of it’s membership”-

Anthony Simon

The confidential Close Call

Reporting System (C3RS)

is a partnership between

NASA , the FRA, Participating railroads

and labor organizations. It is designed to

improve railroad safety by collecting and

studying reports detailing unsafe conditions

and events in the railroad industry.

Employees will be able to report

safety issues or “close calls” voluntarily

and confidentially.